If your state does you may need to report coverage information on your state tax return. Under the Affordable Care Act almost everyone must have health plan coverage.

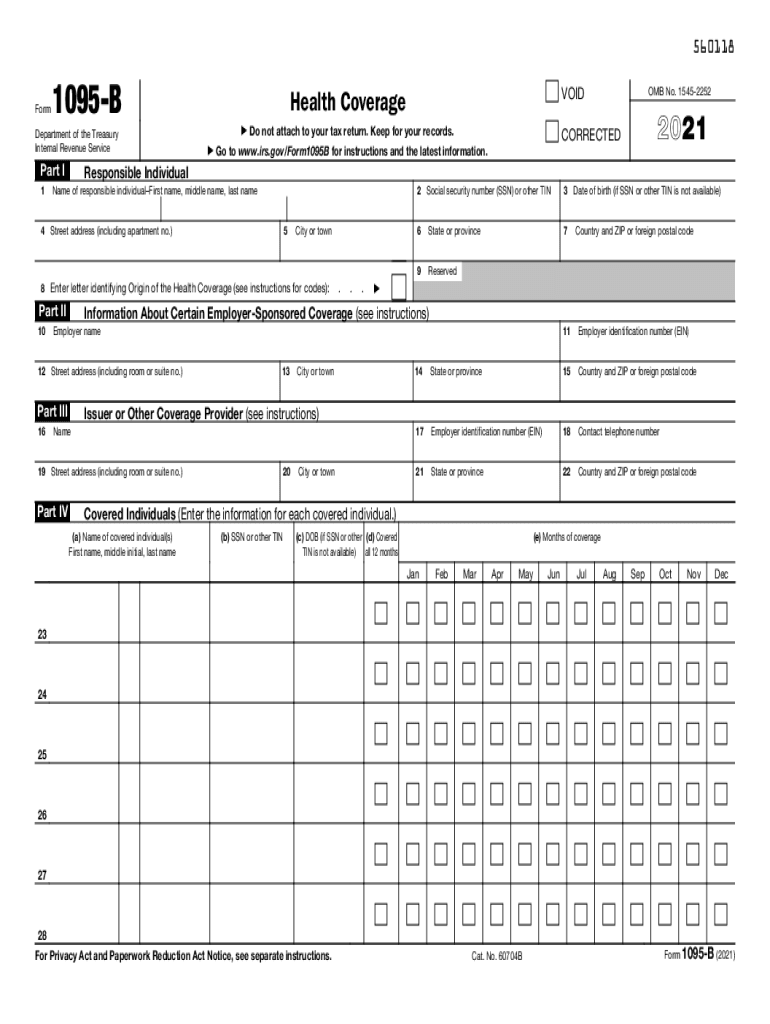

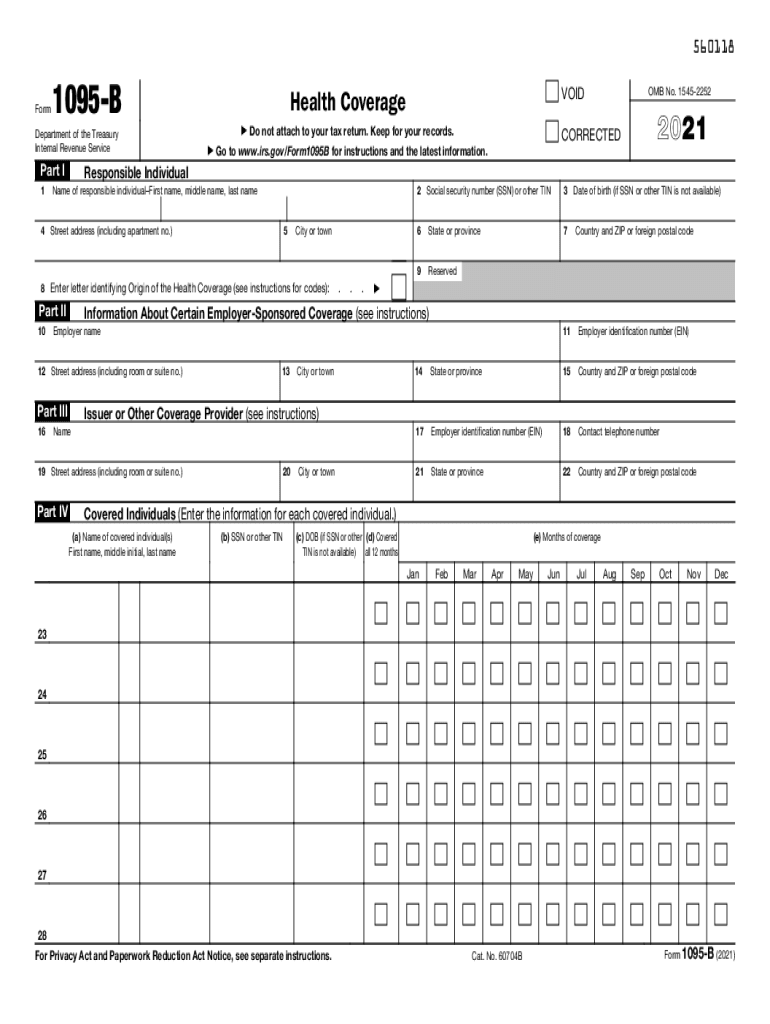

2021 Form Irs 1095 B Fill Online Printable Fillable Blank Pdffiller

California Instructions for Filing Federal Forms 1094-B and 1095-B Pub 3895B PDF updated 022021.

. You do need your Form 1095 to file your federal return if. Read on for more information on Form 1095. You got health insurance through a federal or state marketplace.

The 1095 forms prove you had coverage for the months listed on the form. And electronically files with the IRS once you fill out your forms. They are forms 1095-A 1095-B and 1095-C.

However if you have 300 Forms 1095-C to. You get Form 1095-A. These forms help determine if you the required health insurance under the Act.

FILING INFORMATION RETURNS ELECTRONICALLY THIS US. Each year you may get one or more versions of IRS Form 1095 1095-A 1095-B 1095-C depending on what kind of health coverages you had. If you have 150 Forms 1095-C to correct you may file the corrected returns on paper because they fall under the 250 threshold.

Use of this system constitutes consent to monitoring interception recording reading copying or capturing by authorized personnel of all activities. Sign up for free today and e-file 1099 forms for a low cost. Application for Extension of Time to File Information Returns.

You get Form 1095-B or Form 1095-C. Health Insurance Marketplaces must file Form 1095-A to report information on all enrollments in qualified health plans in the individual market through the Marketplace. For example if you must file 500 Forms 1095-B and 100 Forms 1095-C you must file Forms 1095-B electronically but you are not required to file Forms 1095-C electronically.

GOVERNMENT SYSTEM IS FOR AUTHORIZED USE ONLY. To furnish a statement to individuals will be met if the Form 1095-A is properly addressed and mailed or furnished electronically if the recipient has consented to. Import-in facility supports uploading excel files instead of manually filling out forms.

The new Plus Subscription starting at 149year allows up to 20 users to perform data entry form filing reporting and. The Affordable Health Care Act introduced three new tax forms relevant to individuals employers and health insurance providers. Form 1094-C and Form 1095-C are subject to the requirements to file returns electronically.

Accountants and Tax Preparers use efile4Biz to maintain and file forms for multiple clients under one account every year. If you have less than 250 information returns to file you may report by mail. If you receive a 1095 keep your copy with your tax records.

Businesses use efile4Biz to save on the labor costs of printing mailing and manually submitting forms to the IRS. For individuals who bought insurance through the health care marketplace this information will help to.

B1095b05 Form 1095 B Health Coverage Nelcosolutions Com

California Aca Reporting Requirements Health Care Coverage Health Insurance Coverage Rhode Island

2018 Form Irs 1095 B Fill Online Printable Fillable Blank Pdffiller

1095 B Aca Software E File Print And Mail 1095 B Tax Forms And Envelopes Https Www Accountabilitysoftware Com 1095b Php Tax Software Tax Forms Irs

1094 B 1095 B Software 599 1095 B Software

Aca Form 1095 B Filing Instructions For Health Coverage Providers

0 comments

Post a Comment